idaho child tax credit 2021

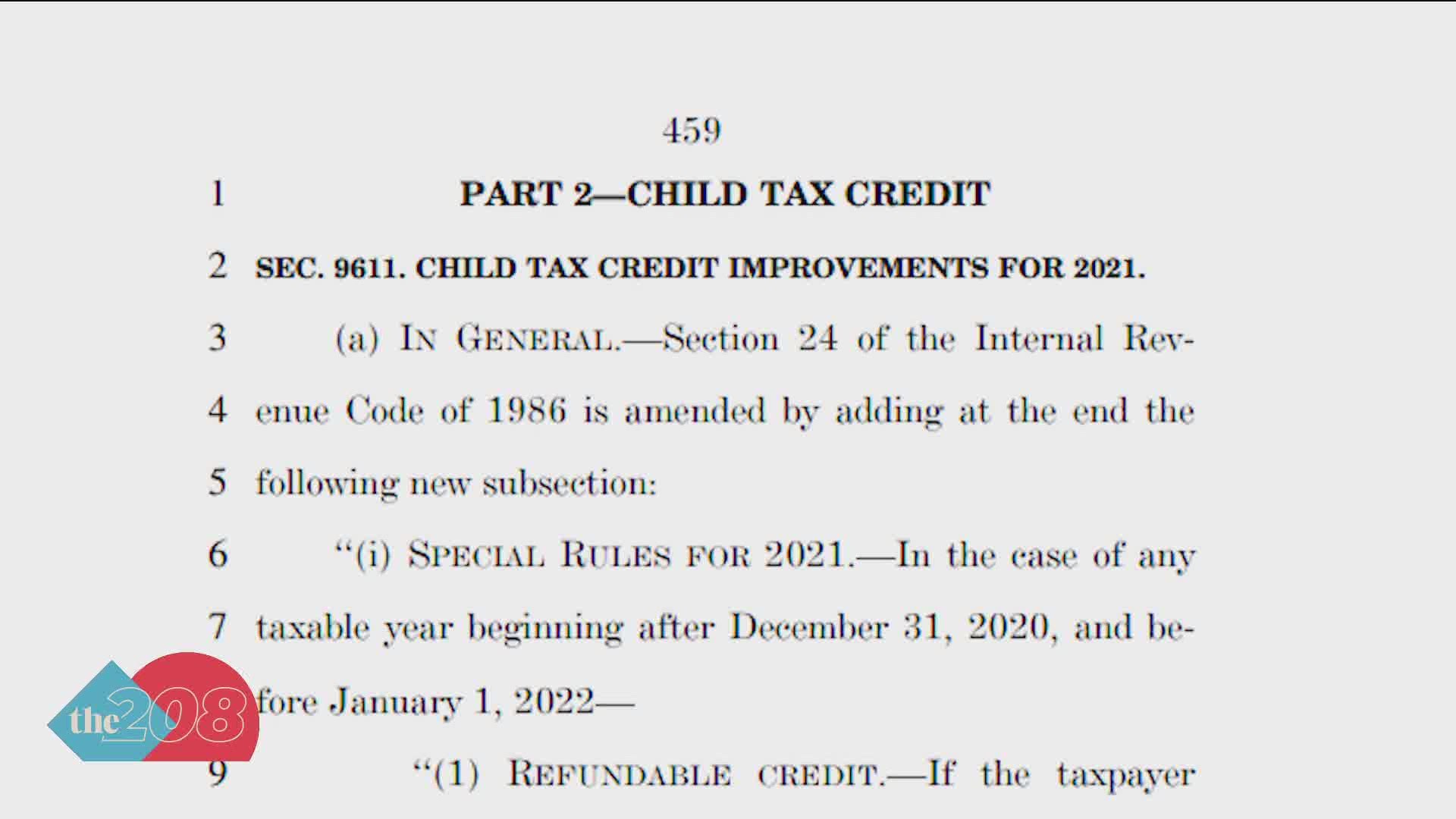

HOUSEHOLD SIZE MINIMUM INCOME MAXIMUM INCOME. Under the American Rescue Plan Act of 2021 the new Child Tax Credit is a refundable credit worth up to 3600 per qualifying child under 18.

Update Child Tax Credit Portal Now If Your Income Changed Forbes Advisor

75 per taxpayer and each dependent.

. The amount of Idaho income tax to withhold is. Father and Mother separated in 2019 and divorced in 2020. You received advance Child Tax Credit payments only if you used your correct SSN or ITIN when you filed a 2020 tax return or 2019 tax return including when you entered information into the Non-Filer tool on IRSgov in 2020 or the Child Tax Credit Non-filer Sign-up Tool in 2021.

Raising the qualifying age for the Idaho child tax credit. Welcome to MyChildSupport Idaho Child Support Services customer portal. Employers and payroll providers.

But the beefed-up credit is only in effect for 2021. Increasing the expenses allowed for the childdependent care deduction. 205 per qualifying child.

Youll see significant changes to the Idaho income tax return starting with the 2018 return. And as dependents for the Idaho grocery credit and Idaho child tax credit for tax year 2019. Most parents automatically get the enhanced credit of up to 300 for each child up to age 6 and 250 for each one ages 6 through 17.

Tax Year 2021 Annual Income limits. Be prepared to provide this information with the application. E911 - Prepaid Wireless Fee.

The amount is based on the most recent approved 2020 tax return information on file at the time the rebate is issued. TaxAct helps you maximize your deductions with easy to use tax filing software. This includes updating the Idaho Child Tax Credit Allowance Table to reflect the lower tax rates.

Child tax credit allowances are. Changes in reporting the charitable deduction for taxpayers taking the standard deduction. Fuels Taxes and Fees.

Idaho allows a deduction for expenses paid to care. Eligible applicants can now apply through the Department of Revenue Service portal by clicking on 2022 CT Child Tax Rebate. House Bill 232 Effective July 1 2021.

1-866-434-8278 toll free Mail. A subtraction for taxpayers with qualified. CHILD TAX CREDIT CTC Rate Nonrefundable.

The Internal Revenue Service has sent more than 15 billion to the parents of. August 10 2021 for tax year 2020. CNN The August child tax credit payment is in the mail or headed directly to your bank account.

Recent laws have changed some 2021 income tax instructions. 3600 for children ages 5 and under at the end of 2021. Advance Child Tax Credit payments were made for qualifying.

Applications opened on June 1 and families that are eligible for the credit are set to get a maximum rebate of 250 which is capped at three children for a total of 750. Since the Idaho child tax credit uses the federal definition Idaho Form 40 line 25 page 9 in the instructions and Idaho Form 43 line 46 page 21 in the instructions should now read. See the changes listed below.

These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022. The individual income tax rate has been reduced by 0475. Then Apply by either.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Idaho Child Care Program. 2 17240 68960.

The IRS is scheduled to send two more monthly payments in 2021. 3 21720 86880. These changes are an increase from last years Child Tax Credit benefit of 2000.

The Tax Commission must follow the law as written John Hancock Mutual Life Ins. Advance Payment of Premium Tax Credit APTC ATTENTION. Weve updated the income tax withholding tables for 2021.

Electricty Kilowatt Hour Tax. The overall package received criticism for not doing enough to help lower-income families in the state and. June 21st 2021 ChildTaxCredit Awareness Day.

Democratic leaders want to extend the monthly payments for certain families for another year as part of the partys 19 trillion spending bill. Weve updated the income tax withholding tables for 2021 due to a law change that lowered the tax rates and decreased the tax brackets from seven to five. More than and Less than 1 965 000 EPB00744 07-07-2021 Page 2 of 3 Table for Percentage Computation Method of Withholding Find the Idaho Child Tax Credit Allowance Table at.

Check out the new withholding tables online Employers and payroll providers. The 500 nonrefundable Credit for Other Dependents amount has not changed. Idaho Illinois Pennsylvania Rhode Island.

Be age 17 or under as of December 31 2021. Recognize the award of tax benefits when allowing the child tax credit under Idaho Code section 63-3029L and the food tax credit under Idaho Code section 63-3024A. 12 of the tax amount reported on Form 40 line 20 or line 42 for eligible service members using Form 43.

Qualifying families will receive half of their credit divided into 6 monthly payments deposited from July to December 2021. The law includes additional tax breaks and a new child tax credit. Child Support Services enhances the well-being of children promotes positive parental involvement and improves the self-sufficiency of families.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021. Petitioner disagreed with the disallowance of the Idaho child. If applying for APTC and applying for or receiving other benefits Download and complete an application.

Idaho has a new nonrefundable Idaho child tax credit of 205 for each qualifying child. Starting on July 15th through December families can get monthly Child Tax Credit payments of 250 per child between 6-17 or 300 per child under 6. Self Reliance Programs PO Box 83720 Boise ID 83720-0026.

2021 Child Tax Credit and Advance Child Tax Credit Payments Topic O. Applications must be submitted by July 31. You dont need to adjust withholding back to the.

Federal credit for child and dependent care expenses increased. Its one of following whichever is greater. 3000 for children ages 6 through 17 at the end of 2021.

You dont need to adjust withholding back to the beginning of the year but please use the revised tables. Based on the information available the children meet the relationship age residency support and joint return tests to be a qualifying child of both Father and Mother. These expanded increased and refundable tax breaks apply for the 2021 tax year and an individual or household can claim both.

Philadelphia Internal Revenue Service 2970 Market St. On March 12 2018 Governor Butch Otter signed legislation to enact a state-level Child Tax Credit worth 130 per child as part of a larger income tax cut package. This includes the Idaho Child Tax Credit Allowance table.

Ad Import tax data online in no time with our easy to use simple tax software.

Team Motivation Horizonpwr Team Motivation Solar Energy Facts Motivation

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Infographic 6 Reasons You Should Choose Kauai For Your Hawaii Vacation Hawaii Vacation Kauai Infographic

Want More Child Tax Credit Money File Your 2021 Taxes Money

New Child Tax Credit Explained When Will Monthly Payments Start Ktvb Com

How To Claim The Child Tax Credit On Your 2021 Taxes Money

Jean Saint Elme Elmejean Twitter Tax Deadline Payroll Taxes Internal Revenue Service

Infographic 6 Reasons You Should Choose Kauai For Your Hawaii Vacation Hawaii Vacation Kauai Infographic

Child Tax Credit 2022 What Changes Will There Be In The New Tax Season As Usa

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Infographic 6 Reasons You Should Choose Kauai For Your Hawaii Vacation Hawaii Vacation Kauai Infographic

How To Return An Improper Advance Child Tax Credit Payment Nstp

Build Skill And Embrace Challenge Horizonpwr Solar Solar Energy Facts Find A Career Above The Line

Ap Macroeconomics Unit 1 Exam Review Jeopardy Template Exam Review Macroeconomics Jeopardy Template

Ability To Respond Horizonpwr Solar Solar Energy Facts Fastest Growing Industries Solar Panel Installation

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Payments Set To Go Out To Tens Of Millions Of Families On Monday East Idaho News

Idaho Families Would Benefit From Move To Include More Children In State S Child Tax Credit Idaho Center For Fiscal Policy